(Foreign issued money orders or checks are also not accepted. NOTE: if using Internet Explorer, you will need to manually enlarge the video pane. We do not accept credit card orders over the phone or through the mail. The department also maintains all county records and oversees a print shop, mailroom and the county’s Central Stores (currently on contract with Office Depot).

Clark county property records wa code#

These laws are set forth in the Revised Code of. Everything is directed from when taxes are due, how payments can be made, and when and why interest, penalties, and fees are charged. Washington Administrative Code chapter 246-272A and Clark County Code 24.17 requires homeowners whose property is not connected to a municipal sewer system to ensure that the property includes an approved, correctly functioning on-site septic system.

Clark county property records wa full#

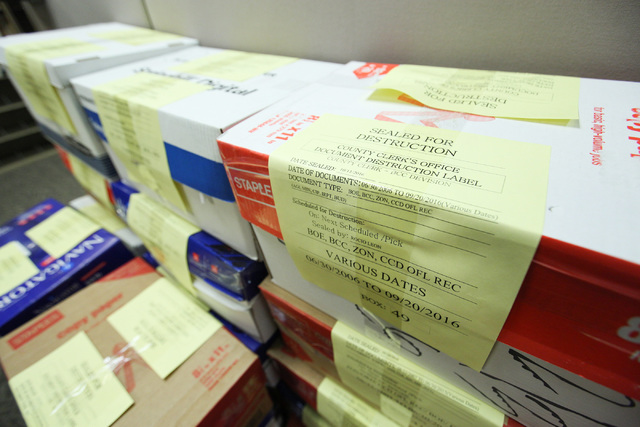

dollars for the full amount, payable to the Clark County Recorder. Internal Services Internal Services provides a variety of necessary internal support services to each county department, including purchasing and facilities management. The billing and collection of property taxes is the responsibility of the county treasurer and is spelled out in Washington State Law. Mail Orders: Send cashier's check or money order in U.S.

(for overnight deliveries) Clark County Recorder's OfficeĪll documents sent from this office will be sent via USPS. Records Search: Locate your document information online.Ĥ. Mail or bring the completed order form and appropriate fees to the Clark County Recorder's Office: Download the Official Records Copy Order Formģ. Fill out the order form with the appropriate information. Visiting our office in person ( Office Location and Hours)ġ.Commercial Appraisal 564.397.4609 AssessorCIMclark.wa.gov. Contact Information by Program To expedite. Locate the document information by: Online Records Search The Park County Assessors Office is responsible for: Locating, valuing, and classifying all taxable property within Park County Collecting and reporting. Follow the Assessors Office on Nextdoor, through Clark County Communications.If you do not have the necessary document information, you may:

0 kommentar(er)

0 kommentar(er)